Explore our Services >>>

INSIGHTS & RESOURCES

VIEW ALL INSIGHTS & RESOURCES

March 06, 2023

Beacon Weekly Investment Insight 3.6.23

Head of Investment Strategy, Brian McGann, CFA, provides insights to guide you through changing market conditions. Please read the full text below or download the PDF version.

The month of February came to a close on Tuesday of last week with US equity markets posting a negative performance month following January’s strength. However, as the calendar turned to March mid-week, performance turned, and the US indices ended the week in positive territory. The Dow Jones Industrials rose 1.75%, the S&P 500 rose 1.90%, and the NASDAQ Composite finished up 2.58%. Surprisingly, interest rates continued to rise with the benchmark 10-Year US Treasury eclipsing 4.0% for the first time since November, before settling at 3.96% on Friday.

The volatility in performance, in our view, will continue as investor sentiment struggles between resilience of the US consumer and economic strength, and the expected rise in interest rates to cool the stubbornly sticky inflation environment. As we had seen in prior reports, inflation measures such as the Consumer Price Index and the Federal Reserve’s preferred measure, Personal Consumption Expenditures, both firmed in January. Additionally, measures in the employment market, such as weekly jobless claims and continuing claims data remain on the stronger side pointing to a continued tight labor market. With this economic strength, confirmed by last week’s ISM Manufacturing and Services data, the expectations for the Fed Funds terminal rate began to creep again to about 5.3%. Talk by some analysts even mentioned a 6% figure.

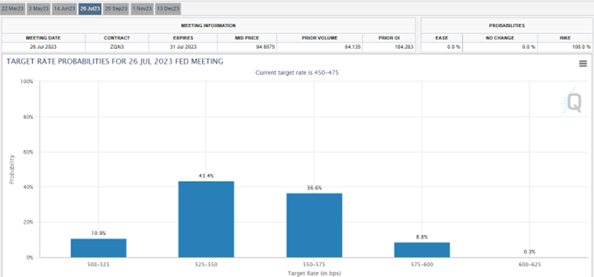

While we do not believe the Fed’s Open Market Committee will become significantly more aggressive with its interest rate hiking cycle, we would agree that the potential now exists for three additional 25 basis point hikes versus initial expectations for only two more this year. As always, the Fed will be mindful of the data releases as the year progresses. Below is a chart based upon the Fed Funds futures market which confirms our thinking and points to a target rate of about 5.50% or 5.75% for the July 26, 2023 meeting.

This week coming up, there are several events for financial markets to react to. Federal Reserve Chairman Jay Powell will testify before the Senate on Tuesday and the House of Representatives on Wednesday regarding monetary policy. Economic releases set for the week will start Monday with factory orders and shipments. Wednesday, the Commerce Department will release the trade balance figures for January, and the Labor Department will release the job openings, quits, and layoff data (JOLTS). We will finish the week with the February employment report. January’s figures for comparison were a surprising 517,000 jobs created and an unemployment rate of 3.4%.

|

Market Scorecard: |

2/24/2023 |

YTD Price Change |

|

Dow Jones Industrial Average |

32,816.92 |

-1.00% |

|

S&P 500 Index |

3,970.04 |

3.40% |

|

NASDAQ Composite |

11,394.94 |

8.87% |

|

Russell 1000 Growth Index |

2,297.26 |

6.44% |

|

Russell 1000 Value Index |

1,519.06 |

1.47% |

|

Russell 2000 Small Cap Index |

1,890.49 |

7.34% |

|

MSCI EAFE Index |

2,035.26 |

4.70% |

|

US 10 Year Treasury Yield |

3.95% |

+7 basis points |

|

WTI Crude Oil |

$76.32 |

(4.91)% |

|

Gold $/Oz. |

$1,817.10 |

-0.50% |